Introduction:

UAE (United Arab Emirates) also known as Emirates is located in Western Asia on Persian Gulf, borders attached with Saudi Arabia, Oman, Qatar and Iran with total population of 9.2 million from which 1.4 million are Emirati and 7.8 million expats.

UAE (United Arab Emirates) is a federation of seven states or seven emirates which are Abu Dhabi, Dubai, Sharjah, Ajman, Ras Al Khaimah, Fujairah & Umm Al Quwain. Abu Dhabi is the Capital of UAE and ruler of Abu Dhabi is the President of UAE. And Ruler of Dubai is the Voice president of UAE.

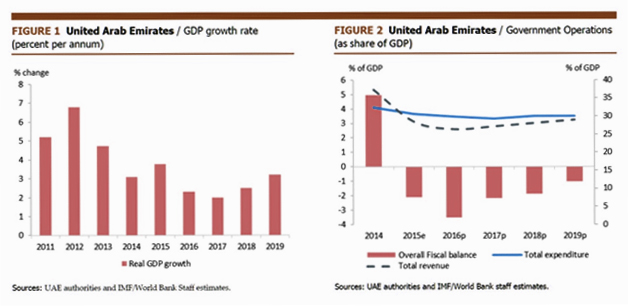

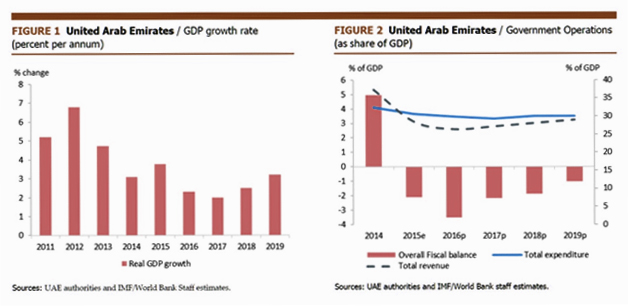

UAE (United Arab Emirates) has the 2nd largest economy in GCC with a gross GDP of $ 377 billion in 2012 and in 2013 it reaches to 1.45 trillion. UAE also ranked as the 26th best Nation. Laws of UAE does not allow any kind of trade unions and Ministry of Labour has the full power and control on workers. Anyone who will do strike will get his work or business permit cancelled and will be deported. That is why there is a regular consistency in economic and business growth.

Note: In Fujairah you can visit or contact at Fujairah Municipality Department.

To view cost in more details, click the link below:

https://easystep.ae/mainland-llc-company-setup-cost.php

Other Nationalities (other than GCC countries) can get other types of businesses and for that they must have UAE national as a sponsor and Local Sponsor must be:

UAE (United Arab Emirates) is a federation of seven states or seven emirates which are Abu Dhabi, Dubai, Sharjah, Ajman, Ras Al Khaimah, Fujairah & Umm Al Quwain. Abu Dhabi is the Capital of UAE and ruler of Abu Dhabi is the President of UAE. And Ruler of Dubai is the Voice president of UAE.

UAE (United Arab Emirates) has the 2nd largest economy in GCC with a gross GDP of $ 377 billion in 2012 and in 2013 it reaches to 1.45 trillion. UAE also ranked as the 26th best Nation. Laws of UAE does not allow any kind of trade unions and Ministry of Labour has the full power and control on workers. Anyone who will do strike will get his work or business permit cancelled and will be deported. That is why there is a regular consistency in economic and business growth.

Setting Up Business in UAE:

According to the UAE (United Arab Emirates) law, foreign entities can establish company or business in Free Zones and Mainland.

1. Business Formation in Mainland

Setting is business in Mainland is very common type of business formation in UAE. To setup business in mainland you need to get license from Department of Economic Development (DED) in most of Emirates and if few Emirates such licenses issued by Municipality Department.Benefits of Mainland Business

There are so many benefits of setting up business in mainland but few of them are:- Ease to do business in any Emirate of UAE

- Unlimited visa quota

- Wide range of business activities

- No business and personal tax

- 100% foreign ownership

- Easy to open Global / Local bank accounts

- No restrictions on funds and profit transfer

- No restrictions on foreign employees hiring

Government Entities

To setup business in mainland (LLC), you have to contact or visit DED (Department of Economic Development) with having office in different Emirates and in some Emirates, you need to contact or visit Municipality Department to get approvals for your business activities and other approvals.DED Office in Emirates

- Abu Dhabi Department of Economic Development

- Dubai Department of Economic Development

- Ra's al-Khaimah Department of Economic Development

- Sharjah Department of Economic Development

- Ajman Department of Economic Development

Note: In Fujairah you can visit or contact at Fujairah Municipality Department.

Chambers of Commerce

To do business in UAE, chamber of commerce is a good source for information and assistance in UAE. Chamber of Commerce have investment database, license information and all other documents relevant to business.- Abu Dhabi Chamber of Commerce

- Dubai Chamber of Commerce and Industry

- Sharjah Chamber of Commerce & Industry

- Ajman Chamber of Commerce & Industry

- Umm al-Quwain Chamber of Commerce & Industry

- Ra’s al-Khaimah Chamber of Commerce & Industry

- Fujairah Chamber of Commerce, Industry & Agriculture

- SYDcasino

Cost

To setup business in mainland it requires investment which will be used for approvals and license fees and residency visa processing. The cost will depend on the following things:- Nature of the business you want to do and it activities

- Size of your office and it’s location

- Number of visas

- Legal form of the company

To view cost in more details, click the link below:

https://easystep.ae/mainland-llc-company-setup-cost.php

Capital Requirement

There is no capital required to setup business in mainland but in few business activities you have to deposit or to show the amount in bank. UAE commercial companies law did not have any specific or minimum capital requirement and should be stated that minimum capital:- Should be mentioned in MOA

- Must be sufficient to incorporation business

Nationality of partners

It is very important thing to determine that what sort of business you can setup in mainland. Few businesses can be setup only by UAE Nationals, which are:- Joint liability company (partners must be UAE nationals)

- Simple commandite company

- Industrial or commercial type sole proprietorship

- Homebased businesses license

- SME licenses

Other Nationalities (other than GCC countries) can get other types of businesses and for that they must have UAE national as a sponsor and Local Sponsor must be:

- Local Sponsorwill hold 51% of ownership while foreign entity can hold 49% ownership or

- local service agent (LSA), with the investor having a 100 per cent ownership of the business

Companies which Require Local Sponsor

- LLC companies

- Public Joint Stock Companies (PJSC) - it must have at least 5 founding members who are UAE nationals, owning between 30 percent and 70 percent of the capital shares

- PRJSC Companies

- Civil company with an engineering activity

CompaniesWhichRequire LSA (Local Service Agent):

- Professional type sole establishment

- Civil company with no engineering activity

- Foreign Company Branch

- Representative office

- Simple commandite companies

2. Business Formation in Free Zones:

There is lot of difference between mainland and free zone, the main difference is nature of the ownership, extension of liability and involvement of Local Sponsor or Service Agent. If you do not want a local sponsor or service agent in your business then setup your business in Free Zone because in free zone you can hold 100% ownership of your company.Free Zone?

Free Zone or Free Trade Zone is a specific area and within that area certain taxes, rules or restrictions on businesses does not apply. Free Zone is normally located with Sea ports, Airports with different business and trade advantages.Benefits of Free Zone

- 100% foreign ownership

- 100% tax free

- 100% repatriation of capital and profit

- 0% corporate tax

- 0% personal tax

- 0% import /export tax

- Business setup within 2 working days

- Wide range of business activities

- Cost effective

License Types:

Free Zone issued following types of business licenses:- General Trading License

- Trading License

- Industrial License

- Service License

- National Industrial License

List of UAE Free Zones

Following is the list of main and popular free zones of UAE:Abu Dhabi:

- Twofour54 Media Free Zone

- Masdar City Free Zone

- Abu Dhabi Airport Free Zone (under development)

- Khalifa Port and Industrial Zone (under development)

Dubai :

- Jebel Ali Free Zone (JAFZ)

- Dubai Airport Free Zone (DAFZ)

- Dubai Internet City (DIC)

- Dubai Media City (DMC)

- Dubai Gold and Diamond Park (DGDP)

- Dubai Cars & Automotive Zone

- Dubai Health Care City (DHCC)

- Dubai International Financial Centre (DIFC)

- Dubai Maritime City

- Dubai Logistics City

- Dubai Knowledge Village

- Dubai Outsource Zone (DOZ)

- Dubai Techno Park (DTP)

- Dubai Silicon Oasis Authority (DSOA)

- Dubai Studio City (DSC)

- Dubai Textile City (DTC)

- Dubai Flower Centre (DFC)

- Dubai Carpet Free Zone

- Jumeirah Lakes Towers Free Zone (JLT)

- Dubai Multi Commodities Centre (DMCC)

Sharjah :

- Sharjah Airport Free Zone (SAIF Zone)

- Hamriyah Free Zone (HFZ)

- SHAMS Free Zone

Ras Al Khaimah :

- Ras Al Khaimah Free Trade Zone (RAKFTZ)

- Ras Al Khaimah Media Free Zone

- Ras Al Khaimah Investment Authority (RAKIA)

Fujairah :

- Fujairah Free Zone (FFZ)

- Fujairah Creative City

Ajman :

- Ajman Free Zone (AFZ)

Umm Al Quwain :

- Ahmed Bin Rashid Free Zone

3. Offshore Company

This type of licenses can be issued to those who are operating a business outside of UAE boundaries. For example, a business in UK opens up a similar enterprise in UAE.Benefits of Offshore in UAE

- 0% tax

- No audit required

- Offshore registration within 1 – 2 working days

- Secure & Confidential data of owners, directors and shareholders

- One director is mandatory and can be increased

- Director of an offshore company in UAE, must have any citizenship

- One owner/shareholder is obligatory for the registration

- Shareholder of the company is eligible to operate the company

- Offshore company must have a registered agent for the official registered company’s address

- 100% foreign ownership

- Offshore company is exempted from any income tax, personal tax and duties

- Offshore can be register without the presence of owner in UAE